Masala Bonds are special in terms of name; These are rupee denominated borrowings by Indian companies in the foreign markets. This contrasts the other foreign borrowings in the fact that in the other foreign borrowings, the currency is typically the dollar, euro, yen etc.

However, issuance of masala bonds means that the company does not have to worry about the depreciation of the currency compared to the other bonds/ instruments which are denominated in the foreign currencies. This is almost the biggest concern of the corporates when they go overseas to raise money. In the case that the rupee loses its value when the redemption of the bonds is going to take place, the company will be required to handover more rupees to settle the dollars.The firms that had borrowed money through the Foreign Currency Convertible Bonds in 2007 landed themselves in a tight situation with much difficulty because the rupee had deteriorated at a very sharp tone during the global financial crisis.

To counter the risk of losing the value of currency, the investor purchasing the Masala Bond will obtain a higher coupon rate and hence yields more.The foreign funding under the masala bonds was counted as the corporate debt as well as the external commercial borrowing of the company.

The Regulations are recently being amended by the Reserve Bank of India and currently are treated by the former as,The ECB bonds category alone where a borrower need only request the approval of RBI to sell such securities.

Maturity period and the ceiling of all-in-cost and the recognized lenders (investors) of Masala are provided in this respect.

Specific Provisions:

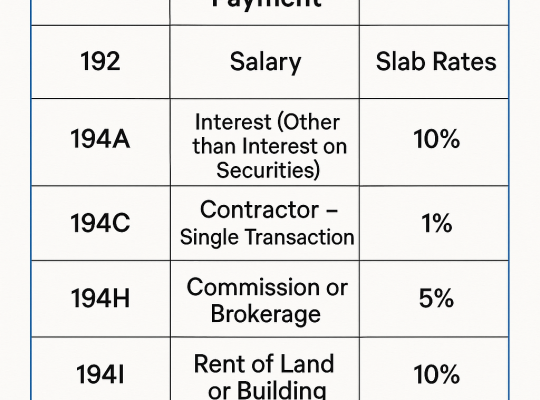

Feature Details

Maturity Period – Max 50 mils USD (INR equivalent): Min 3 years

- More than USD 50 million: Min 5 years

All-in-Cost Ceiling The most that can apply is 300 basis points in excess of a prevailing yield of similar Government of India instruments

Recognized Investors Just authorized bodies as in RBI Master Direction No.5 (2016). Not related parties (as defined by Ind-AS 24).