The act of running away

You may be a freelancer, YouTuber and online seller on Amazon, Upwork or Flipkart, and you might have noticed that TDS is deducted from your payment amount received

Section 194O of TDS has been reduced to 0.1 percent that will take effect from October 1, 2024.

How does this affect you and what can you do to reduce tax deductions? Let us find out.

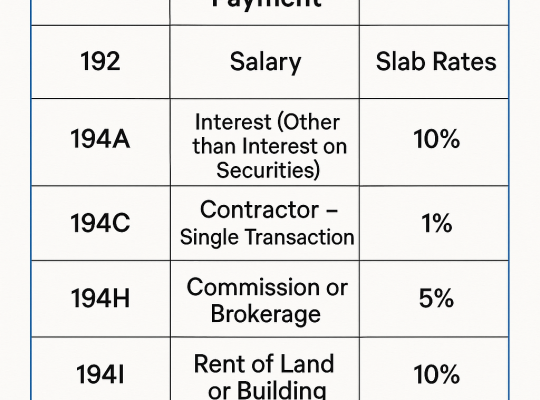

What is the Section 194O?

For E-commerce platforms (Amazon, Meesho, UrbanClap, Upwork, etc.)

New TDS Rate: 0.1% (w.e.f. 1 st October 2024)

Old Rate: 1% (Until 1 st October 2024)

Threshold: 5 lakh per annum (PAN needed)

Example:

Suppose you gain 10 lakh through Amazon after Oct 2024, TDS will be 1,000 and not 10,000.

section 194Q?

Applicable to: Buying of resident sellers goods >50 lakh/year

TDS Rate: 0.1 per cent on amount which is above 50 lakh

Affected mostly: not freelancers, B2B transactions

What can be done to minimize or prevent the effect of TDS

1. Submit Your ITR and Get Refunds.You can get a complete refund of the TDS deducted even when your income is less than the taxable limits.

2. Make sure that PAN is Supplied,TDS will be at most 5 % without PAN. Never fail to check KYC on sites.

3. Match Form 26AS and AIS.Keep track of all the TDS deductions you make and also compare it with your income to prevent mismatch and notices.

4. Presumptive Tax Schemes. freelancers and professionals could choose 44ADA, which makes the tax simpler and prevents audit

TDS Before and Now:

| Period | TDS Rate (u/s 194O) | TDS on ₹10 Lakh Income |

|---|---|---|

| On or before Oct 2024 | 1% | ₹10,000 |

| Oct 2024 onwards | 0.10% | ₹1,000 |

✅ That’s ₹9,000 extra in your pocket — all because of the rate change!

Pro Tip

Register Proprietorship or Business Entity

In case your annual earnings exceed 10L-15L:

Register as sole proprietorship,

Apply GST (where necessary)

Tracking should be better through business bank account

Summing Up

Never lose track of TDSFile,your return to get refunds.Keep yourself informed on changes such as this one in taxes